5 reasons to consider an ESOP

- Genevieve Adams

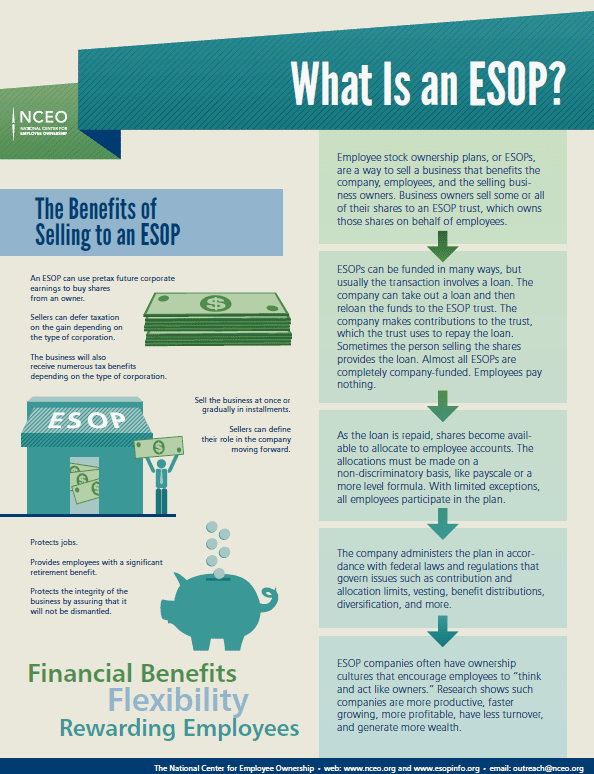

What is an ESOP?

What is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a retirement plan, similar to a 401k plan or retirement profit-sharing plan—but with a big difference. The function of an ESOP is to buy company stock, and then hold it as a retirement investment for the employees.

ESOPs are authorized to borrow money to finance the purchase of stock, and, as a result, employees don’t pay for the stock purchase. The better the company performs, the more the shares are worth, and employees thereby reap more of the rewards from the work they put into the company.

Why should I consider an ESOP?

1. They have tax advantages.

The tax savings from selling to an ESOP can often amount to as much as the sale price itself. The tax savings occur at several levels:

- The company: The company’s debt service payments in an ESOP transaction are tax-deductible. In California, this means saving over 40% of the cost of the purchase.

- The seller: When selling stock to an ESOP, the seller can potentially defer capital gains taxes on the transaction—which can be more than 33% of the sale price.

- The employees: ESOPs shares are not taxable as compensation the way an award of regular stock is. This saves employees as much as 37% on state and federal taxes.

2. They’re customizable.

With an ESOP, you can sell any portion of the company—the ESOP will pay market value for any part.

Let’s say you aren’t ready to retire completely, but you’re getting close and want to start taking a step back from the day-to-day operations. You can sell part of your ownership to the ESOP, which motivates your employees to take on more responsibility and assume an ownership mentality, allowing you to reduce your work hours.

3. You control the transaction.

With an ESOP there is no pushy buyer across the table. You choose when to sell, and how much to sell. You can opt to sell the business altogether or sell it in installments over time. You also can determine what your role will be in the business going forward.

4. Your legacy stays intact.

You’ve worked hard to build your business, and if you’re like many business owners, you’d like it to live on with its legacy intact. An ESOP means the business will not merge with a larger company that will change it beyond recognition, or close its doors for good. It means keeping your hard-working staff still employed and the business rooted in your community and contributing to the local economy.

5. They help improve workplace culture.

Research suggests that when employees have a stake in the company, they work harder and smarter. By having part-ownership through an ESOP, employees no longer just punch the clock. Your business becomes their business too. An ESOP can make an impact on your employees’ lives and can create a shift in the workplace culture. All benefits of the ESOP model both financial and cultural are stronger when implementation of the financial instrument is combined with participatory management and employee engagement.

For more information on ESOPs visit:

The Beyster Institute: ESOP 101

NCEO ESOP (Employee Stock Ownership Plan) Facts

This article was adapted from an article by Martin Staubus of The Beyster Institute, one of Project Equity’s partner for ESOP transactions.